#didyouknow the interest you pay on educational loan can be claimed as deduction u/s 80E and THERE IS NO UPPER LIMIT for claiming this deduction.

So, if you take loan at interest rate of 9% and you fall under tax slab of 30% - your effective interest rate will be 6.3% and not 9%!

Deduction is available to the one who has taken educational loan for self/spouse/children/of whom he is a legal guardian. Also, this loan can be taken for higher studies in India or abroad.

So, whoever falls in the higher slab in your family should take the loan and avail this tax benefit.

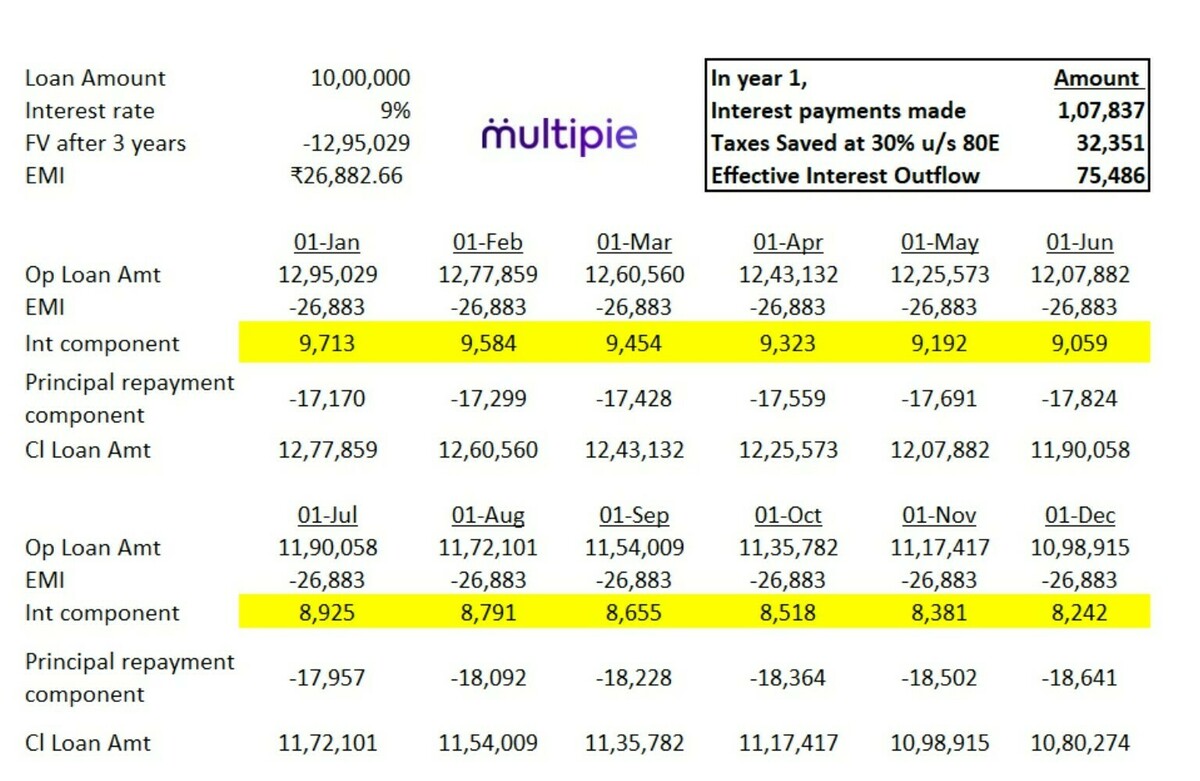

Below screenshot will help you understand the calculation of interest payment that becomes due assuming its a 5-year loan to be repaid starting from Year 4 cause in the first 3 years, the student will be studying & not repaying the loan.

Hope this adds on to the knowledge of Multipie Community.

#personalfinance #80E