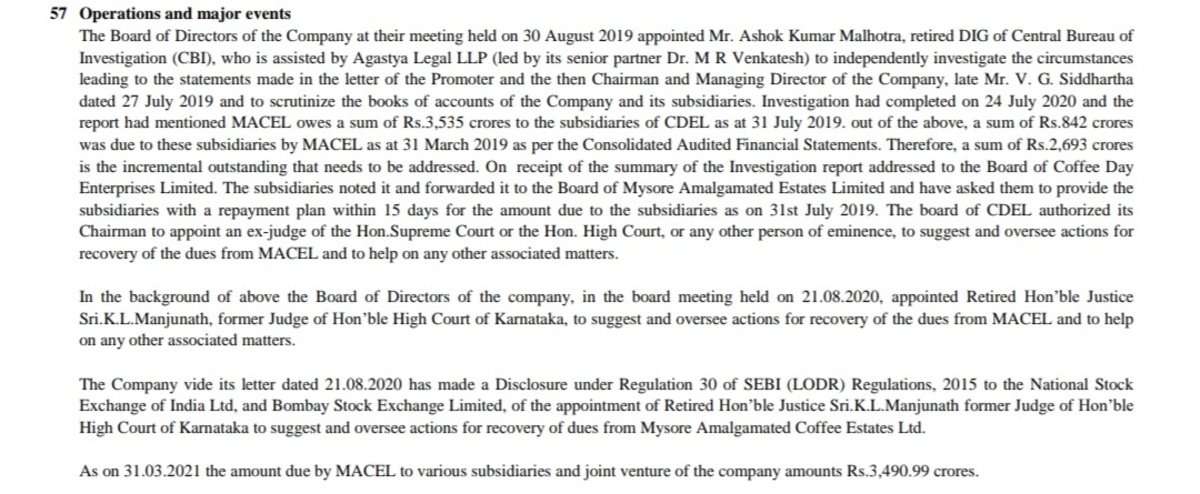

There has been lot of PR about debt reduction on $Coffee Day Enterprises Ltd on social media. But at the end of the day the fact of the matter is that 3500 cr was transferred to promoter group co (out of which only 850 cr was disclosed and balance came into light as part of the investigation) which never came back to the company (see image).

Further, the debt reduction was not made out of any operating cash flows or promoters infusing any funds in the co but through sale of stake in Mindtree to L&T, sale of IT park to Blackstone and sale of Way2Wealth to Shriram Group.

The most that promoters lost was that their pledged stake was invoked by lenders. So if one considers the diversion of funds from the co which never came back, one can conclude that promoters got a good valuation for their invoked shares indirectly.

Further, the debt reduction was not made out of any operating cash flows or promoters infusing any funds in the co but through sale of stake in Mindtree to L&T, sale of IT park to Blackstone and sale of Way2Wealth to Shriram Group.

The most that promoters lost was that their pledged stake was invoked by lenders. So if one considers the diversion of funds from the co which never came back, one can conclude that promoters got a good valuation for their invoked shares indirectly.