$TajGVK Hotels & Resorts Ltd

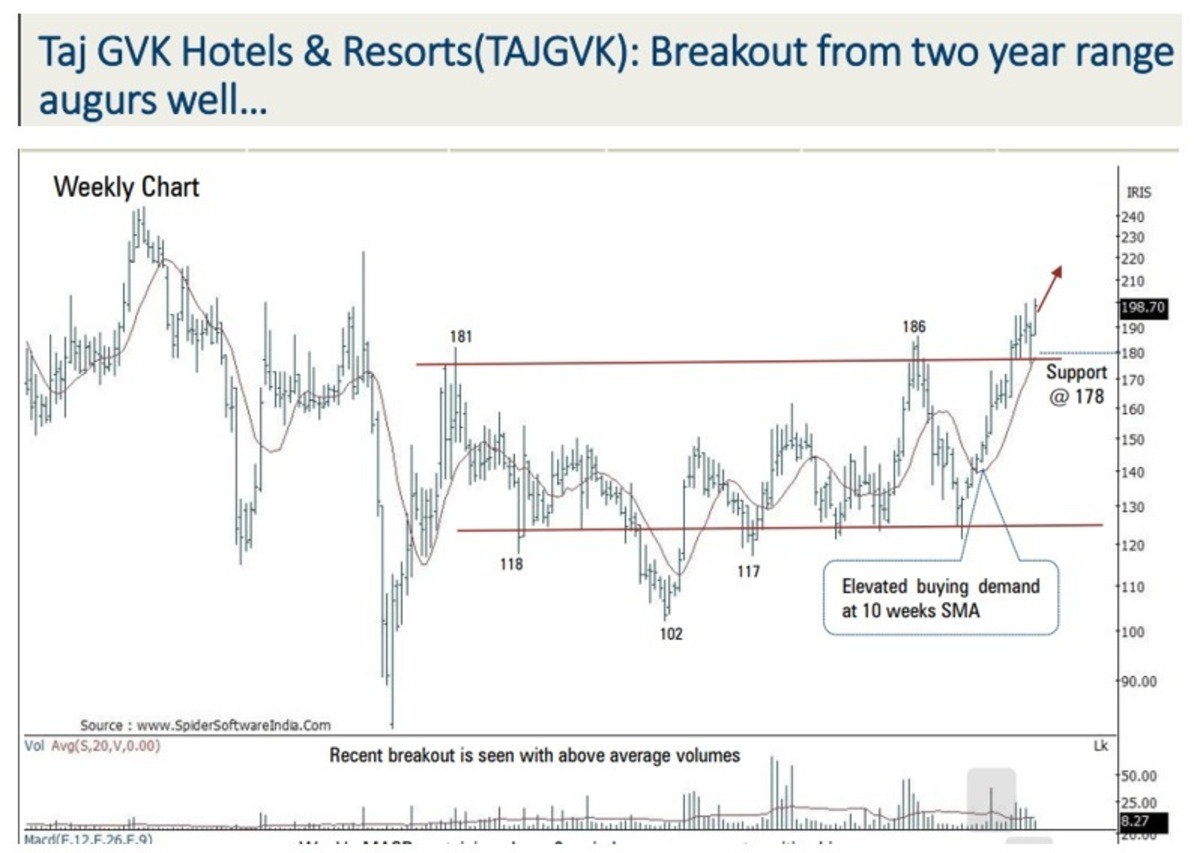

𝐓𝐚𝐣 𝐆𝐕𝐊 𝐇𝐨𝐭𝐞𝐥𝐬 & 𝐑𝐞𝐬𝐨𝐫𝐭𝐬: 𝐁𝐫𝐞𝐚𝐤𝐨𝐮𝐭 𝐟𝐫𝐨𝐦 𝐭𝐰𝐨 𝐲𝐞𝐚𝐫 𝐫𝐚𝐧𝐠𝐞 𝐚𝐮𝐠𝐮𝐫𝐬 𝐰𝐞𝐥𝐥💯🎯

• Hospitality sector has been a key outperforming sector in CY22 as the stocks resolved out of multiyear underperformance as tourism picked up after two year Covid induced interval

• Taj GVK’s share price is resolving out of two years of base formation and surpassing pre-Covid levels backed by above average trading volumes. The stock is also outperforming over past few weeks as it witnessed resilience during corrective phase of September 2022

• The weekly MACD is seen diverging from its nine period’s average signifying strong momentum from a medium term perspective

#ICICIDirect

𝐓𝐚𝐣 𝐆𝐕𝐊 𝐇𝐨𝐭𝐞𝐥𝐬 & 𝐑𝐞𝐬𝐨𝐫𝐭𝐬: 𝐁𝐫𝐞𝐚𝐤𝐨𝐮𝐭 𝐟𝐫𝐨𝐦 𝐭𝐰𝐨 𝐲𝐞𝐚𝐫 𝐫𝐚𝐧𝐠𝐞 𝐚𝐮𝐠𝐮𝐫𝐬 𝐰𝐞𝐥𝐥💯🎯

• Hospitality sector has been a key outperforming sector in CY22 as the stocks resolved out of multiyear underperformance as tourism picked up after two year Covid induced interval

• Taj GVK’s share price is resolving out of two years of base formation and surpassing pre-Covid levels backed by above average trading volumes. The stock is also outperforming over past few weeks as it witnessed resilience during corrective phase of September 2022

• The weekly MACD is seen diverging from its nine period’s average signifying strong momentum from a medium term perspective

#ICICIDirect