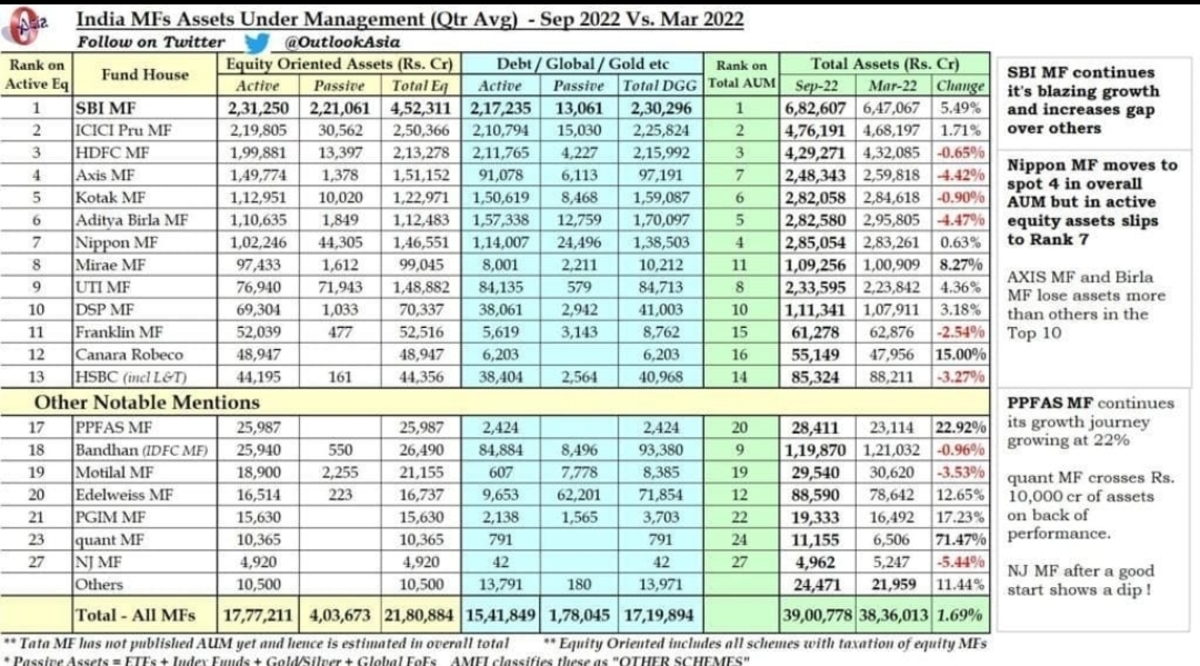

Data on Mutual Fund wise AUM, break-up and growth between March 22 and Sep 22 (6 months). Some observations:

1. Total assets held by Indian MF industry is Rs 39 Lakh crore of which 56% in Equity MF and 44% in Debt/Global/Gold Fund schemes.

2. SBI MF is the largest across both equity and debt and growing faster than industry at 5.49% vs 1.69% for the industry.

3. Amongst the large MFs (50k crore+) fastest growing are Canara Robeco and Mirae MF at 15% and 8.3% respectively.

4. The fastest growing MF overall is Quant MF (CIO: Sandeep Tandon) at 71.5% in last 6 months driven by outperformance - 4 of 5 schemes have a 5 year CAGR of 20% or higher. AUM > 10K crore.

5. The second fastest overall is PPFAS at 22.9% driven by core philosophy and word of mouth.

6. Two large MF houses which have lost some AUM (4-5%) are Axis MF and Aditya Birla MF both impacted by internal breaches.

@Raj @Wolverine @Sandeep Baid @Hiren Thakkar @Mayank

1. Total assets held by Indian MF industry is Rs 39 Lakh crore of which 56% in Equity MF and 44% in Debt/Global/Gold Fund schemes.

2. SBI MF is the largest across both equity and debt and growing faster than industry at 5.49% vs 1.69% for the industry.

3. Amongst the large MFs (50k crore+) fastest growing are Canara Robeco and Mirae MF at 15% and 8.3% respectively.

4. The fastest growing MF overall is Quant MF (CIO: Sandeep Tandon) at 71.5% in last 6 months driven by outperformance - 4 of 5 schemes have a 5 year CAGR of 20% or higher. AUM > 10K crore.

5. The second fastest overall is PPFAS at 22.9% driven by core philosophy and word of mouth.

6. Two large MF houses which have lost some AUM (4-5%) are Axis MF and Aditya Birla MF both impacted by internal breaches.

@Raj @Wolverine @Sandeep Baid @Hiren Thakkar @Mayank