𝗗𝗼𝗲𝘀 𝗵𝗶𝗴𝗵 𝗣𝗘 𝗺𝘂𝗹𝘁𝗶𝗽𝗹𝗲 𝗻𝗲𝗰𝗲𝘀𝘀𝗮𝗿𝗶𝗹𝘆 𝗶𝗻𝗱𝗶𝗰𝗮𝘁𝗲 𝘄𝗲𝗮𝗹𝘁𝗵 𝗱𝗲𝘀𝘁𝗿𝘂𝗰𝘁𝗶𝗼𝗻?

There are many talks on how companies like Nykaa have PE multiples of ~814x before listing and have reached ~1600x after listing.

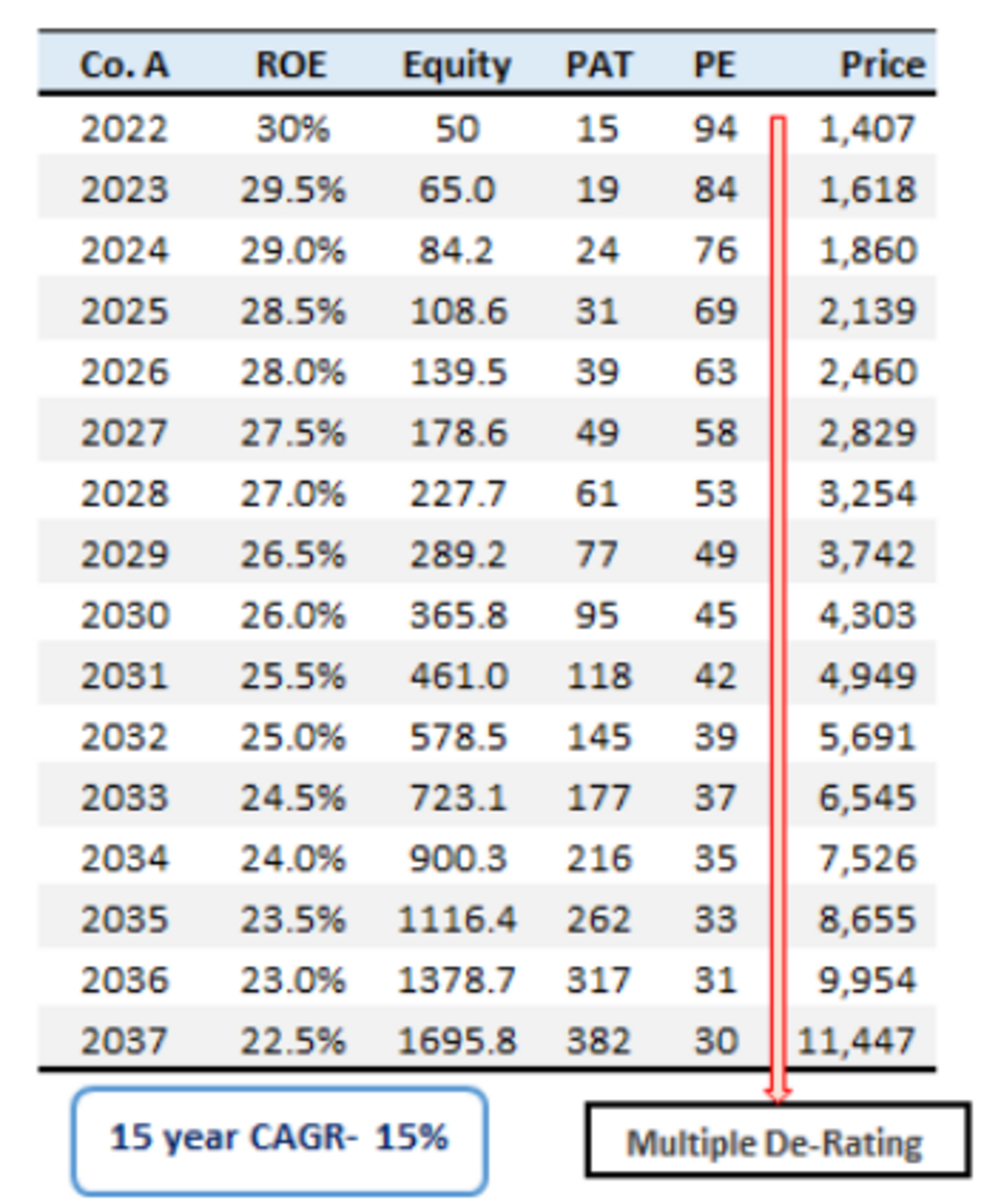

Say Company A has a PE of 126x currently. This might scare away many value investors but does this necessarily mean there is no value? Let’s understand.

What if I tell, you can still earn 15% CAGR consistently for the next 15 years even with multiple derating? Assuming 100% of profits reinvested in the business itself with consistent ROE’s

There are many talks on how companies like Nykaa have PE multiples of ~814x before listing and have reached ~1600x after listing.

Say Company A has a PE of 126x currently. This might scare away many value investors but does this necessarily mean there is no value? Let’s understand.

What if I tell, you can still earn 15% CAGR consistently for the next 15 years even with multiple derating? Assuming 100% of profits reinvested in the business itself with consistent ROE’s