$K P R Mill Ltd #mystockpitch

KPR Mill Ltd is a vertically integrated apparel manufacturing Co. It is also present in Sugar and Ethanol Business. Yarn, Garment and Sugar segment contribute 43%, 39%, 14% of FY21 revenue resp.

China +1 strategy, Government Schemes (RoSCTL), Mega Textile Parks, Ethanol Blending program(20%) are all acting as catalyst to the Company’s Growth.

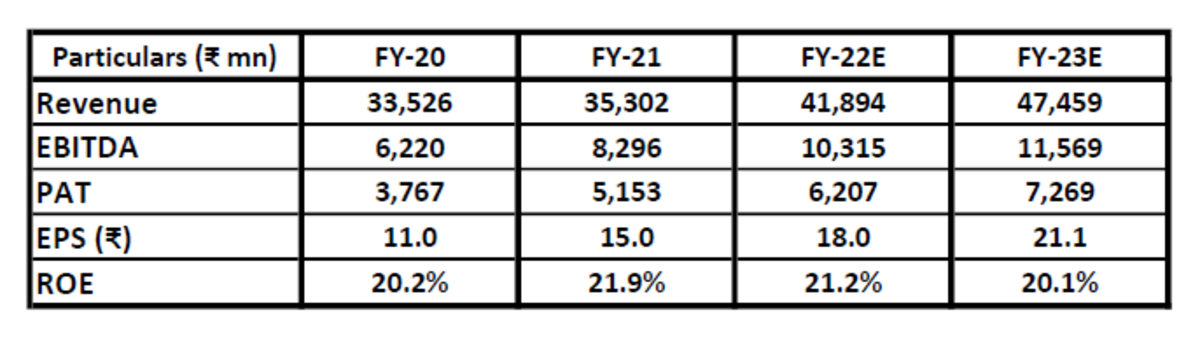

KPR is expanding its garment capacity from 115 mn to 157 mn garments pa. It is also setting up a Sugar, Co-Gen-cum-ethanol plant which is double the existing Capacity. This Capex will help capitalize the incremental demand which will further drive the Revenue. Increased realization, self sufficiency in Power Generation, Appropriate Product mix with preference for Valued Products will help sustain the EBITDA Margin. The Co has good Bal Sheet position with Net Debt/Equity of 0.25.

With Industry Tailwinds and Co's Step in right direction, the growth trajectory of KPR looks promising.

KPR Mill Ltd is a vertically integrated apparel manufacturing Co. It is also present in Sugar and Ethanol Business. Yarn, Garment and Sugar segment contribute 43%, 39%, 14% of FY21 revenue resp.

China +1 strategy, Government Schemes (RoSCTL), Mega Textile Parks, Ethanol Blending program(20%) are all acting as catalyst to the Company’s Growth.

KPR is expanding its garment capacity from 115 mn to 157 mn garments pa. It is also setting up a Sugar, Co-Gen-cum-ethanol plant which is double the existing Capacity. This Capex will help capitalize the incremental demand which will further drive the Revenue. Increased realization, self sufficiency in Power Generation, Appropriate Product mix with preference for Valued Products will help sustain the EBITDA Margin. The Co has good Bal Sheet position with Net Debt/Equity of 0.25.

With Industry Tailwinds and Co's Step in right direction, the growth trajectory of KPR looks promising.